Investment Philosophy

At Asymmetric Advantage, we treat the market as a relatively uncertain dynamic system (a machine). Using analytical and statistical methods together with classic financial models we then make decisions to buy, sell, protect, and optimize. Our most important objective is to limit the downside volatility (risk), while letting the upside run. We choose investments by implementing protective layers (filters), which help to contract the universe by excluding unfavorable holdings. A good analogy is to recognize that the best way to find a needle in the haystack is to remove the hay from the stack.

Mutual Funds

Our experience and analyses show that it is not necessary to hold a large number of mutual funds to achieve a required diversification. Actually, having too many such holdings often produces a portfolio that mimics patterns of the overall market. In addition, it adds to the complexity, increases transaction costs and tends to reduce alpha (the premium that an investor receives from her/his portfolio performance above the market). In general, a portfolio of 8-12 carefully chosen mutual funds can be efficient and well diversified.

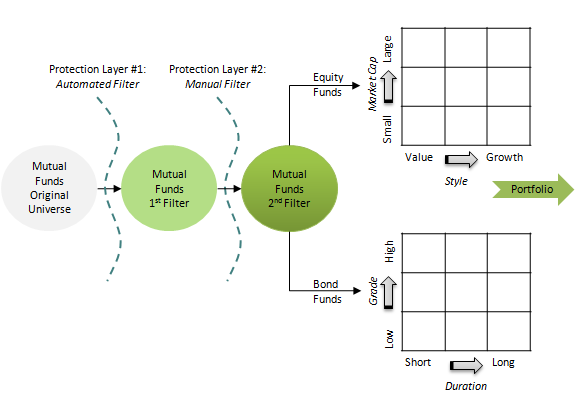

As with all our investments we start with a large universe of available mutual funds and pass each of them through filters or "layers of protection".

The first filter is derived from our proprietary grading system combined with a Morningstar rating, risk and performance data, consistency results, managers' tenure, largest dropdowns and several other key parameters. These filters remove more than 95% of the funds from further consideration.

Next, the second filter (Protection Layer #2 in the diagram) is applied. Here, we go through each fund's portfolio, tax efficiency, expenses, and management style. This further reduces the number of funds, leaving only a few final candidates in each category. Characteristically, these remaining highly-graded mutual funds demonstrate low bear market volatility, tight expense ratios, strong performance records, proven managerial skills, and consistency in historical risk and performance parameters.

Finally, the remaining funds are separated into domestic and international equity funds and then into the groups based on the fund's investment style. The bond funds are separated by the bond ratings and average duration. In the cases of specialty funds and emerging market funds, we frequently choose their equivalent ETF (see ETFs below).

Stocks

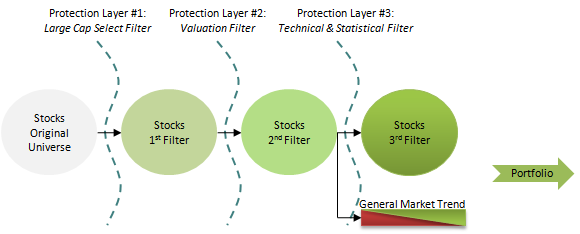

We use our own proprietary investment system for choosing stocks in our portfolios. The system was developed over the course of six years. It combines detailed valuation analysis with technical and quantitative, statistical analyses. Using similar to the mutual funds elimination approach, we start with a significant universe of stocks, and then apply very restrictive layers of protections (filters) to get rid of unfavorable holdings.

Filter #1 - The original stock universe is significantly reduced by concentrating on publically traded, highly liquid, large cap, dividend-paying company stocks; many with "wide moat" advantages.

Filter #2 - We then run a valuation analysis and eliminate currently overpriced companies.

Filter #3 - Using statistical and probabilistic analyses we then chose stocks which are least likely to depreciate over the next few months up to a year. Collectively, this step also generates a signal to remain 100% market long or to allocate a certain percentage to cash, bonds or bear market ETFs (explained below).

Although most of our stock holdings are in the large cap, dividend-paying universe, we will occasionally hold a no-dividend or mid cap stock for which the current valuation is extremely attractive (deep value).

ETFs

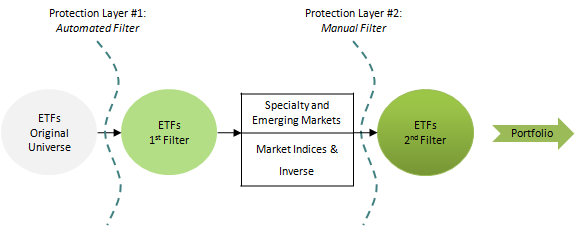

There are several functions for the ETFs in our portfolios. If our process indicates that stocks in a certain category are undervalued and have potential to appreciate in the next few months, we can buy an ETF in that category.

Additionally, a small portion of the portfolio can be allocated to emerging markets ETFs. These ETFs are usually more volatile than the overall market, especially when the market is falling. Therefore, we actively manage these positions. In bear markets, we sell long ETF positions, and substitute this portion of the portfolio with inverse market ETFs.

We start with the large universe of ETFs and run our proprietary system to reduce the universe. We divide the ETFs into various categories. An additional filter is applied, using Morningstar data to further validate the ETF choices.

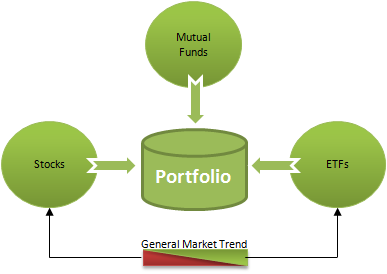

Portfolios: Putting It All Together

The separate holdings - mutual funds, ETFs and stocks - are then systematically weighted and combined to form an optimal, customized investor portfolio. Depending on an investor's risk tolerance, goals and preferences, the portfolios can vary from being all stocks to all mutual funds and ETFs. An investor also has an option to invest in our Focused Active Management Strategy portfolios. These are concentrated, actively managed portfolios of stocks and ETFs. These portfolios utilize the best of our tools and knowledge, and are suitable for many investors.

We focus on constraining downside volatility while letting the upside run.